The Sino-US trade war is heating up, the global economic outlook is unclear, and the financial “doomsday theory” is rekindling! Following the global smartphone “One Brother” Hon Hai Chairman Guo Taiming warned that a larger tsunami than the financial tsunami is about to come, it is more likely that after a short period of time, Nomura Securities quantitative team analyst Masanari Takada also issued a similar “doomsday prediction.”

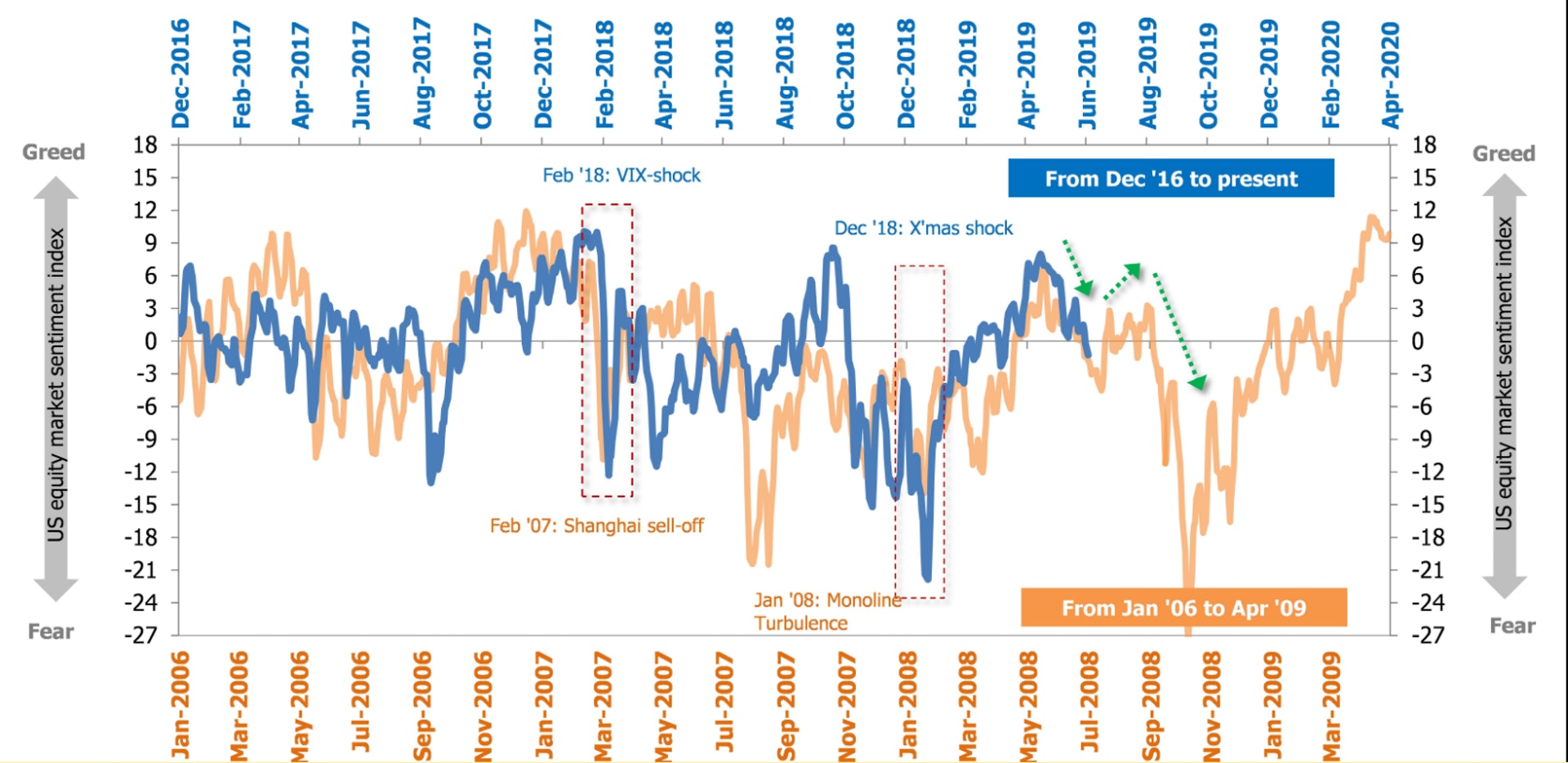

According to Bloomberg, Takada quoted a “US stock market sentiment index” that reflected market panic and greed, bluntly saying that the current sentiment in the US stock market is gradually similar to the pattern before the 2008 Lehman crisis (see chart).

According to the above indicators, the index may fall by about 20% on average, and the worst case is about 40%. In the six months after Lehman Brothers filed for bankruptcy in September 2008, the index’s decline was in line.

Before the “final fall”

Takada said that the current market model is reminiscent of the June 2008 scenario, when investors were worried about global economic growth and stock market adjustments. He pointed out that before the city of Da Lat, there was a comforting rebound in US stocks from July to August 2008. He said that the stock market is currently heading towards the situation from June to July 2008.

Therefore, Takada warned that we are likely to be in the second big wave, but before the “ultimate drop”, he also compared the December 2018 sell-off with the January-March 2008 sell-off. December is traditionally a good month for US stocks to perform well, but in December last year, the market worried that the Fed’s interest rate hike triggered an excessive recession and that the Washington stock market crashed, the US stock market index plunged 1,655 points or 6.87% a week for 2008. The worst of the month! Takada continued, this is why it takes some surprises to get the market sentiment to deviate from this ominous model as quickly as possible.

On September 15, 2008, Lehman Brothers, an old US brokerage, filed for bankruptcy protection in New York, triggering a sharp fall in US stocks. The index fell from the 1250 level and continued to fall to around 670 in March of the following year. Slow climb.