On July 1, local time, the Ministry of Economy, Trade and Industry officially announced that it will supply South Korea’s “fluoropolyimide” (PI), “photoresist” and “high purity hydrogen fluoride” (ie, electronic grade hydrogen) from the 4th. Important industrial raw materials such as hydrofluoric acid have eliminated their “white list of preferential treatment”. The above three types of products that were originally transported point-to-point from Japan to South Korea will encounter an export license and review period of about three months.

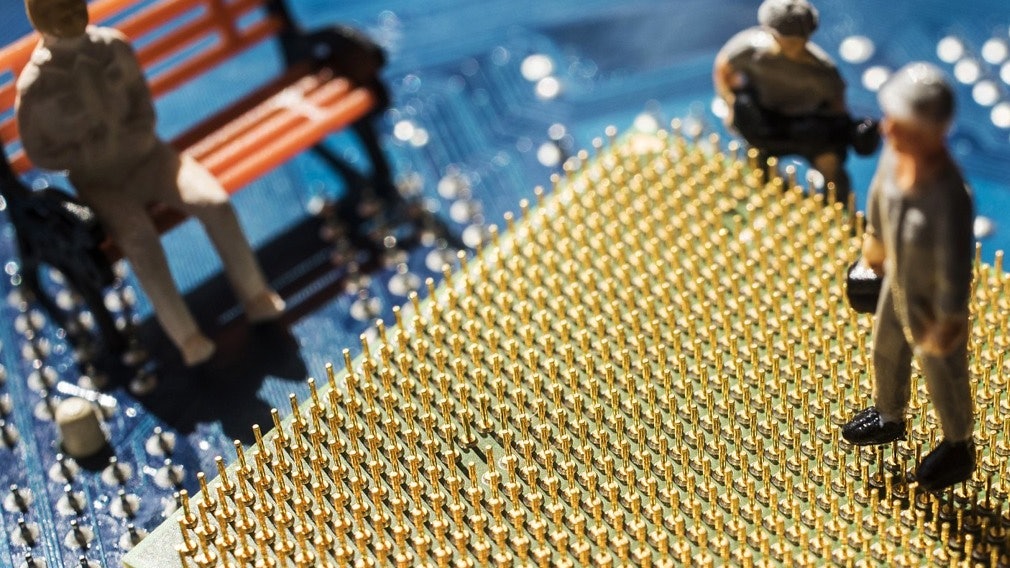

The above industrial products are widely used in the manufacture of liquid crystal displays (LCDs) for televisions, organic light-emitting diode (OLED) displays for manufacturing smartphones, and manufacturing industries such as semiconductors and integrated circuits. This will undoubtedly be a fatal blow to the Korean panel and semiconductor industry, which has many gaps in the industry chain. Seoul’s industry and academia are so heart-wrenching.

Many Korean media are keen to link this storm with the “World War II” labor compensation incidents between Japan and South Korea in the past two years, and try to make the outside world think that this storm may be a policy adjustment between Japan and South Korea. But it is not in the eyes of economic observers. As the China-US trade war began to accelerate the integration of the global industrial chain from March 2018, major industrial countries such as Japan and the United States are seeking to exclude countries in the downstream industrial chain. The technology and material flows of China, Japan and South Korea in the fields of integrated circuits and displays have become the epitome. This storm seems to have become a fission product of the global storm in the Far East.

According to the data, South Korea’s share of the LCD field has been greatly eroded by China until May 2019. At the same time, China has surpassed South Korea in areas such as OLED patent research and development. Japan’s demand for advanced products such as electronic grade hydrofluoric acid is gradually being filled by China. Korean companies are gradually showing their downstream industrial chains and even “founders” in the trend of trade wars. The direct links between China and Japan are becoming more and more close. This storm will also bring about a crisis and even a blow to the Korean panel industry so that the outside world can re-recognize what the reconstruction of the global industry chain means.

A blow to South Korea

For analysts who have recently focused on Japan and South Korea’s development, after the “cold period” of Japan-Korea relations entered diplomatic relations in the past 50 years, the economic relationship between the two countries was gradually formed by the “US-Japan-ROI alliance.” Encounter the impact. In Seoul, as a result of the “Women’s World War II Labor Litigation” issue, it was a viable option for Tokyo to choose to “discontinue the supply of some Japanese goods to South Korea” when it insisted on liquidating the decision of the former government.

For some of the economic and economic circles in Seoul, Japan’s confession of South Korea may not be a crisis or even an opportunity. After all, South Korea is still the world’s largest raw material market for memory production equipment, with a market share of around 53%. Japanese companies such as Toshiba and Sharp have not spared any effort to fill the gap. However, this storm will eventually bring direct blows to panel and display giants such as South Korea’s Samsung Display (SDC) and LG Display.

At present, Japan accounts for 90% of the global PI total capacity and 70% of the total electronic hydrofluoric acid production capacity. Because the former is mostly used for printing and manufacturing the important “image film” part of the LCD display, the latter is mainly used for cleaning and etching precision components such as semiconductors and large-scale integrated circuit boards. When Japan relies on delays in supply pressure, South Korea’s related industries that lack production capacity should be able to feel the impact for the first time.

Similarly, South Korea’s microelectronics, semiconductor, OLED and mobile phone manufacturing industries are also facing direct pressure from Japan.

South Korea’s OLED screen evaporation process equipment still relies on the Canon’s Canon Tokki vaporizer; the lithography equipment used in its liquid crystal display mask (photomask) mostly relies on the technology of Japan’s Dainippon Printing (DNP). South Korea’s mobile phones and panels use glass and iron-nickel-cobalt super-invar (Super-Invar), which also requires the use of finished products from Japan’s Asahi Glass (AGC) and Hitachi Metals. At this point, the storm has already made the outside world realize that South Korea’s technology accumulation is in the lower position of the industrial chain than Japan. This role can often be replaced or even canceled in the current trade war that swept the world.

In contrast, industries such as hydrofluoric acid in Japan are currently relying heavily on raw materials supplied by China. China’s LCD, OLED

Sovereign research and development capabilities

In fact, South Korea has more than once discovered the risk of becoming a foundry because of its lack of competitiveness in manufacturing after 2019. Despite the US-led Western economic system, the advancement and retreat of the Korean industry will not immediately affect the country’s economic situation. However, South Korea’s political status in the international environment will certainly be greatly impaired, and it will become a founder of the United States, Japan and even Europe, just like the role played by the Taiwan region. This may also be what Seoul wants to avoid.

According to data from the Bank of Korea, the country’s trade surplus in 2018 was US$76.41 billion, an increase of 1.6% over the previous year. This is also the 21st consecutive year that South Korea has maintained a surplus. However, both the country’s two major export products, automobiles and semiconductors, have experienced both declines in production and exports. This situation is directly related to international trade frictions, falling chip prices, and the US trade war with major auto-producing countries.

It is precise because of the right to speak in related industries that South Korea has sufficient economic gaming capabilities instead of playing the founders of the United States, Europe and Japan. However, the blow from related industries in Japan may seriously threaten South Korea’s bargaining power and even economic sovereignty in related industries. For example, Taiwan, the former “Military comrades” of South Korea, has played a perfect negative teaching material on industrial issues. In the 1990s, due to the economic downturn in the 1990s, the lessons of gradually losing the ability to speak politically were worthy of attention.

According to the data, Taiwan’s economy has always lacked a solid industrial foundation and is called a “shallow-disc economy” by the academic circles. The high-tech industry that emerged on the island after the 1990s failed to make a breakthrough in deepening the industrial base. Taiwan’s electronics industry is important, but it is more involved in the OEM model. In addition to the lack of depth in the industry, the added value that can be generated is easily compressed by changes in the external market. The service industry in Taiwan is also suffering from weaknesses such as scale dispersion, slow technological progress, and conservative business practices. The political status of Taipei due to its economic status is obvious.

For Seoul, which hopes to further the DPRK-ROK issue, South Korea’s economic status not only determines their ability to speak on the peninsula but also ensures the independence of their political entities.

At present, China, Japan and other countries have won the space for survival in the global trade war launched by Donald Trump because of their intellectual property rights and industrial R&D capabilities. When Japan and South Korea also threatened the key resources of semiconductors and LCD panels in this trend, the game based on the economic foundation will also allow the outside world to re-understand the industrial chain migration brought about by China-US trade disputes.

and other industries are also on the rise. With the capital flow gradually turning to the Chinese side, Canon Tokki even chose not to sell equipment to China in 2018. The pressure of the market and raw materials in this storm has made South Korea see the possibility that its panel industry will be completely annihilated.