The political situation in Hong Kong is still quite tense. US President Trump is more clear about the current developments. Due to the influence of the political market, Hong Kong stocks opened 91 points lower this morning, the decline intensified to nearly 400 points, and 27,000 points fell again.

The Hang Seng Index was last reported at 26,847 points, 460 points; the China Enterprises Index was last reported at 10,331 points, down 164 points.

Real estate stocks remained weak today. Henderson Land Development (0012) reported a new 10.0 yuan, down 1%. Sun Hung Kai Properties (0016) fell 1.6%, the latest report was 123.1 yuan, New World Development (0017) reported 11.44 yuan, down 1.7%. Cheung Kong Group (1113) fell 2%, the latest reported 57.6 yuan.

The rent-receiving shares were also awkward. The Link Real Estate Fund (0823) fell 1.3%, the latest report was 94.85 yuan, Wharf Real Estate (1997) fell 1%, the latest report was 51.75 yuan, and Hysan Development (0014) reported the latest 38.8 yuan. The one-month low was down 2.3%.

Mobile device stocks fell

Mobile phone equipment stocks continued to find the bottom, Sunny Optical (2382) fell 1.7%, the latest reported 67.95 yuan, AAC (2018) fell 1.1%, the latest reported 41.65 yuan, Hongteng (6088) fell 2%, the latest reported 3.01 yuan.

In terms of financial stocks, HSBC Holdings (0005) fell 1.4%, the latest report was 63.8 yuan, AIA (1299) fell 2.4%, the latest report was 73.3 yuan, Standard Chartered Group (2888) fell 1.9%, the latest report was 67.4 yuan.

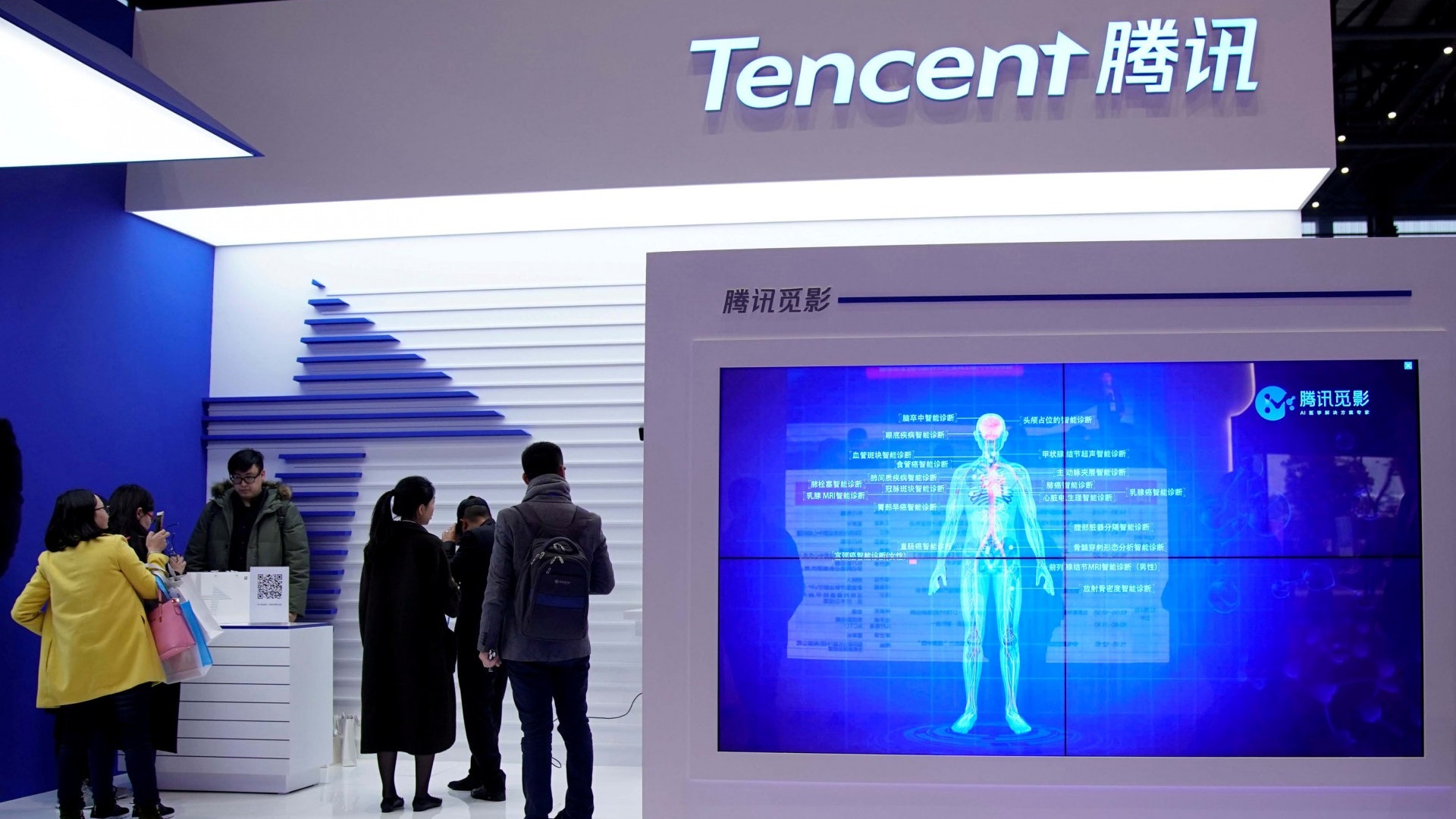

Heavyweight Tencent Holdings (0700) fell 2.4%, the latest reported 329.4 yuan.