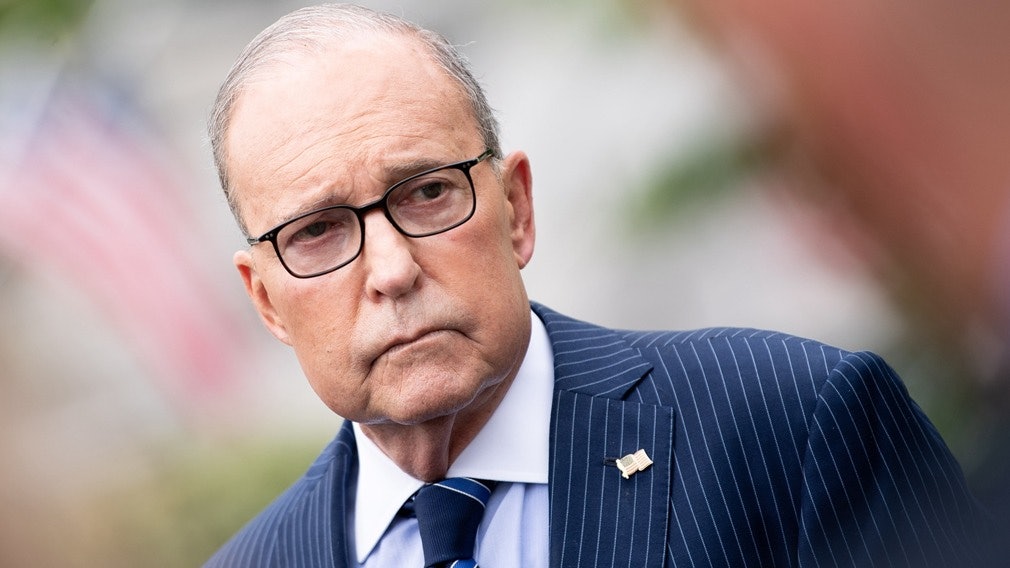

The US-China trade war is facing the risk of further escalation. The White House chief economic adviser Kudlow said recently that the flexibility of US tariffs on China is related to the progress of the US-China negotiations.

Comprehensive media reported on August 7 that White House chief economic adviser Larry Kudlow said on August 6 that although the US-China trade war escalated into a currency war, President Trump remained open to trade agreements and the president Also willing to remain flexible on tariffs, but this depends on the progress of trade negotiations.

Kudlow said that Donald Trump plans to continue trade negotiations with China, and the US President’s Office is still planning to host China’s further negotiations in September.

Kudlow also said: “He wants to reach an agreement. But this must be a correct agreement for the United States. We will prefer a commercial transaction.”

He said: “Our goal is to reduce the tariff rate to 0% and eliminate trade barriers. US President Trump expressed hope that our delegation plans to travel to China in September. If China reduces trade barriers, With the implementation of the reform, we will export billions of tons of products to China and sell our services, and we will resume normal trade balances. We are ready to negotiate, and the close to good deals is a positive signal that can change Tax status.”

He added that if China-US trade negotiations progress in September, the status quo of tariffs may change.

US President Trump issued four consecutive Twitter announcements on August 1 that he will impose a 10% tariff on Chinese goods worth $300 billion from September 1.

Under Trump’s threat of new tariffs, Beijing’s successive counterattacks first caused the yuan’s exchange rate against the US dollar to fall “breaking seven” and then announced a moratorium on the purchase of new US agricultural products. The US Treasury also immediately made a move to list China as a currency manipulator.

For the United States to list China as a currency manipulator, CNN believes that the US-China trade war has always been serious, but it is now beginning to become terrible.

The article said that the US-China trade conflict has reached a new level of severity and is difficult to reverse. The risk is that the trade war has reached a turning point, which can bring about a serious economic slowdown and even a recession.

Joseph Gagnon, a senior fellow at the Peterson Institute for International Economics, said the heavy move was seen as a political strategy aimed at providing Trump with more ammunition and justifying tariffs.

Regarding the US move, the People’s Bank of China issued a statement saying that China deeply regrets this. This label does not meet the quantitative standards of the so-called “currency manipulators” formulated by the US Treasury. It is a wayward unilateralism and protectionist behavior that seriously undermines international rules and will have a major impact on global economic finance.

The Chinese Ministry of Foreign Affairs also stated that the US side disregarded the facts and the quantified standards of the so-called “currency manipulators” that it had formulated, and unreasonably labeled China as a “currency manipulator”. It was announced on August 1 that it would propose a $300 billion commodity to China. After the addition of tariffs, another bad act of escalating trade disputes.